– By Nirmal Kumar S/ Researcher

India continues to surge ahead in digital banking, online shopping, and instant UPI payments. While these advances make life easier, they have also made bank customers across India prime targets for cybercriminals.

In 2025, fraudsters are no longer sending simple phishing messages, they are creating entire fake worlds, including apps, websites, and “customer support desks,” specifically designed to trap unsuspecting account holders.

Scams targeting all major Indian banks are increasingly difficult to spot. A single click can lead to financial loss or identity compromise. Verified reports from 2025 show victims losing thousands of rupees, sharing personal data with scammers, or falling prey to fake loan and investment schemes.

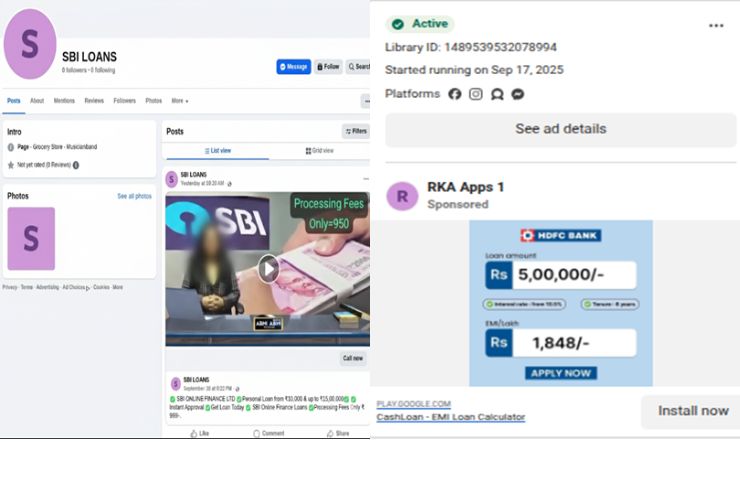

One of the most common scams this year involves fake loan approvals. People receive SMS or email messages claiming to come directly from their bank, complete with official-looking logos and letterheads. Victims are tricked into paying “processing fees” to release a loan. Verified complaints confirm multiple cases of losses in this scheme.

Another alarming trend: deepfake voice technology. Victims receive phone calls where scammers impersonate their bank manager’s or relationship officer’s voice, convincing them to share OTPs, passwords, or other sensitive details. Authorities warn these calls are now highly sophisticated and extremely difficult to detect.

Example of reported fake loan post content in 2025:

Profile Link: https://www.facebook.com/profile.php?id=61581479080497

Ad URL: https://www.facebook.com/ads/library/?id=1489539532078994

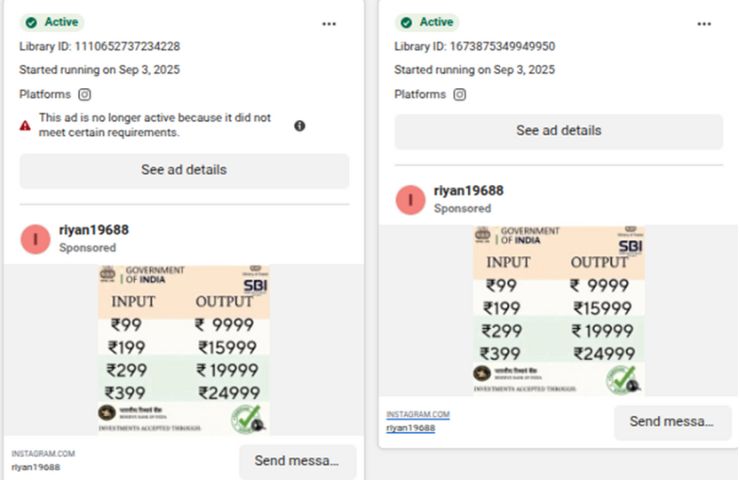

Investment scams are spreading rapidly, especially on social media and messaging apps. Fraudsters create fake dashboards showing fictitious profits, AI-generated videos of “successful investors,” and cloned websites of legitimate banks.

Some platforms even allow small withdrawals at first to build trust, but once larger sums are deposited, the websites vanish. Verified reports in 2025 include families losing significant savings after trusting such schemes.

Fraudsters are now targeting families struggling with EMIs, tuition fees, and medical expenses, exploiting their desperation by offering “quick loans” or “high-return investments.” Many scammers even hire fake customer service executives to chat with victims daily on WhatsApp, gradually collecting personal and financial details. These tactics are highly psychological; they prey on emotions rather than logic, making it extremely difficult for stressed families to recognize the fraud until it’s too late.

With millions of customers across public and private sector banks, fraudsters are creating:

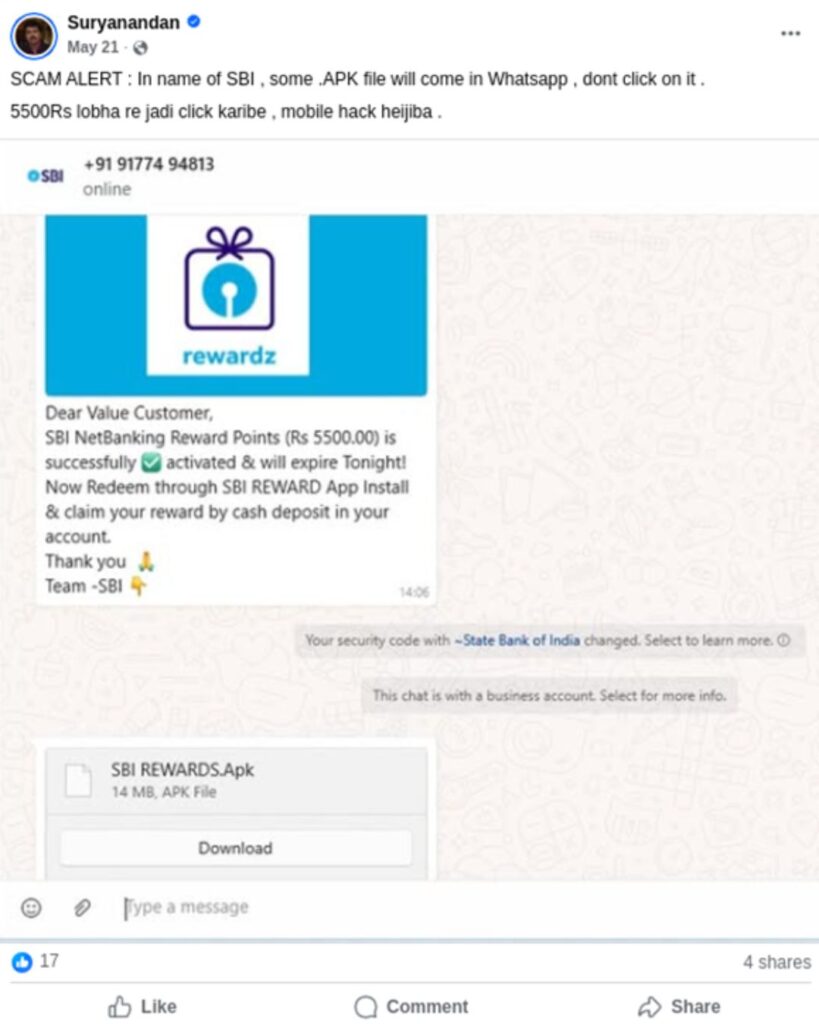

Fake banking apps:

Verified Proof, APK scam: Legitimate banks do not send APK files over WhatsApp for any purpose. However, scammers have been circulating an SBI rewards.apk via WhatsApp:

Post Content : “SCAM ALERT : In name of SBI , some .APK file will come in Whatsapp , dont click on it . 5500Rs lobha re jadi click karibe , mobile hack heijiba .”

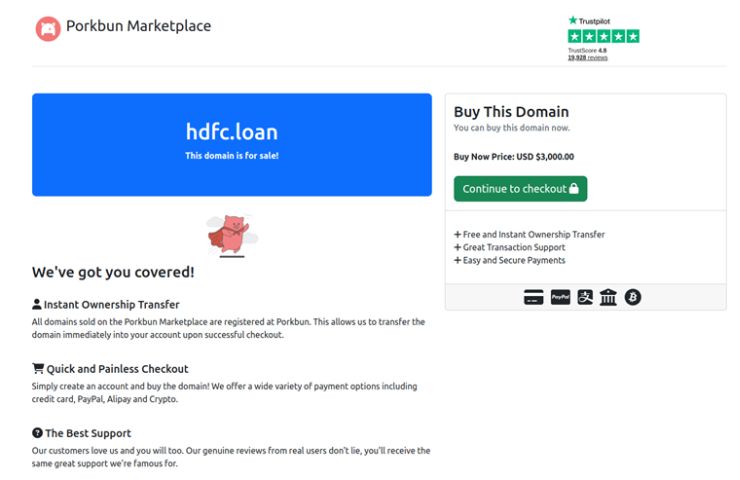

Verified Proof: Cloned/typo-squatted domain: The domain HDFC. loan was used as a cloned/typo-squatted URL to mimic HDFC Bank. It is currently a parked domain (no legitimate bank content), a common tactic scammers use to host fake pages or redirect victims to malicious sites.

Verified Proof: Impersonating Facebook profiles detected posting fraudulent loan offers:

These traps look real, but they’re all part of organized scam networks.

Social media in 2025 has become a key space where victims share their experiences. Verified posts and screenshots of phishing SMS, fake bank alerts, and fraudulent loan approvals are powerful warnings.

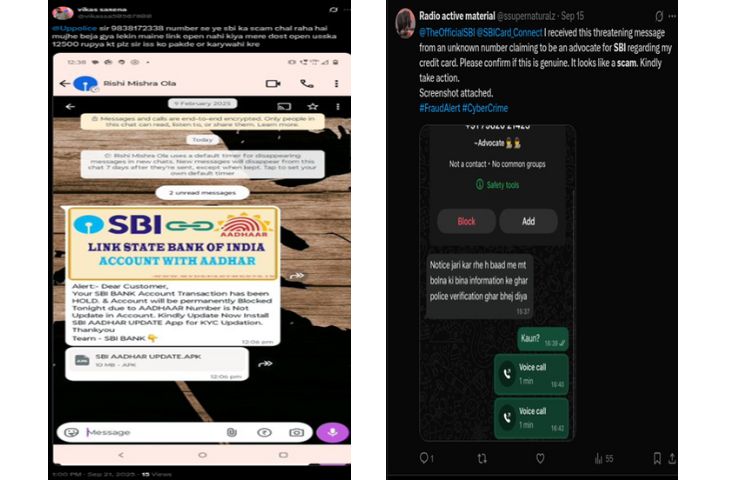

Reported SMS from 9838172338 claiming to be SBI. The recipient avoided the link, but a friend who clicked reportedly lost ₹12,500. [Insert source if available]

A concerned user tweeted:

“@TheOfficialSBI @SBICard_Connect I received a threatening message from an unknown number claiming to be an advocate for SBI regarding my credit card. Please confirm if this is genuine. It looks like a scam. Kindly take action.”

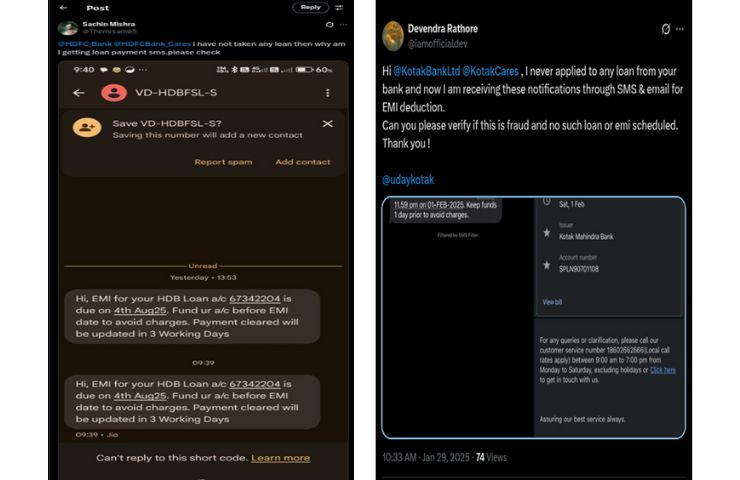

A customer raised concern on Twitter:

“@HDFC_Bank @HDFCBank_Cares I have not taken any loan then why am I getting loan payment SMS. Please check.”

This shows how scammers are sending fake loan-related SMS even to customers who have never taken a loan.

“@KotakBankLtd @KotakCares I never applied to any loan from your bank and now I am receiving these notifications through SMS & email for EMI deduction. Can you please verify if this is fraud and no such loan or EMI is scheduled? Thank you! @udaykotak”

This year’s scams are terrifying because they blend technology and psychology:

Even cautious users can be tricked when under pressure from urgency, fear, or fake authority.

Awareness is the strongest defense. Every citizen should:

2025 has proven that cyber scams are more advanced and dangerous than ever. From fake banking apps to deepfake fraud, criminals are constantly refining their tricks. Fighting these scams is not just about better firewalls – it’s about keeping people alert, informed, and willing to report. The silent trap is everywhere: SMS, calls, social media, and apps. Recognizing it before it snaps shut is the only protection.

Remember: Staying informed is no longer optional. A single click can drain savings or shatter a family’s financial security. Vigilance is survival.

Disclaimer:

This blog is based on independent research, analysis of publicly available information, and customer complaints related to banking frauds and scams in India. The content is intended solely for awareness and educational purposes. It does not aim to defame, discredit, or spread misinformation about any bank, financial institution, or individual mentioned herein.

You may also like to know about Could You Be Next in Line for the Second Currency Prison Trap?